Understanding Art as an Investment

Art consistently holds its value over time, standing robust against the whims of the market, unlike more volatile investments such as stocks or real estate. When global markets tremble, art often retains its value, appreciating discreetly but surely. This aspect makes art an attractive option during economic uncertainty.

Art investment requires a deep understanding. Each piece of art, unique in its existence, emerges not just as decor but as a repository of cultural value and historic importance. Every art piece connects the past with the evolving present, carrying deep-rooted significance alongside its fiscally appreciated worth.

The art market moves to a different rhythm than its finance counterparts; its pulse set by cultural trends and the prestige of specific artists rather than sheer market speculation. Investing in art also ventures beyond mere acquisition; one embarks on a lifelong educational journey. Learning about artists, their styles, and societies crafts a deep personal enjoyment and enrichment bypassing simple material ownership.

However, liquidity can be a challenge in art investment. Selling a piece often requires the right market conditions or finding a buyer willing to pay your piece's valuation.

When tastes change, your investment's fate can sway dramatically. Thus, despite its seemingly stable nature, art presents investors with both opportunities and challenges.

As an investor deliberating on the art market, approach it with vigilance and embrace the magnificence and the challenges alike. Each piece carries its own narrative, waiting to unfurl — each struck in their still silence until the opportune moment arrives.

Navigating the Art Market

Traversing the art market requires not just an appreciation of aesthetics but also an understanding of market dynamics. This necessitates an examination of the trajectories of artistic value, which can enhance one's capabilities as an investor.

Provenance is crucial. This enquiry into the artwork's history—from its initial creation through various ownerships over the years—unearths aspects that affect its market value. Documentation detailing authenticity and a record of previous ownerships ensures transparency, reducing risks associated with provenance issues.

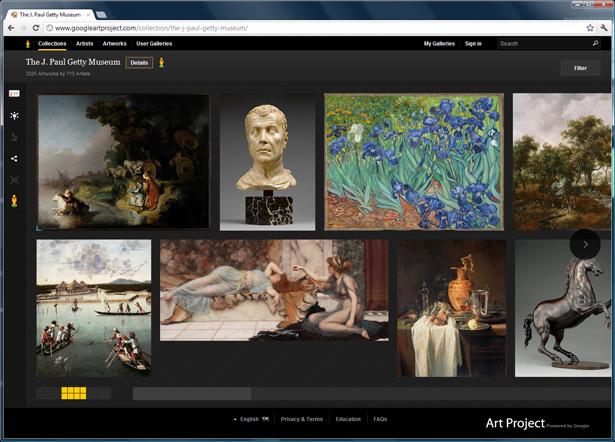

Staying informed of market analytics is essential. Keeping abreast with trends in art sales, auction results, and market shifts influenced by geopolitical and societal undercurrents provides a pragmatic overview for making decisions. The globalized nature of today's art market includes international fairs, digital platforms, and transitions in collecting trends that demand continuous observation.

Engagement with art advisors and consultants can be advantageous. These experts provide insights, forecast investment risks, and pinpoint opportunities informed by their grasp of the global art landscape. They act as a bridge to accessibility and deeper market penetration.

Collaborating with an art consultant or advisor aligns one's passion for collecting with strategically informed purchases. These professionals aid investors in navigating intricacies: from ensuring due diligence in acquisitions to diversifying an art portfolio resonant with both growth potential and personal taste.

As art continues to hold a reverential position, investments channeled through informed, advised pathways can translate into secure asset growth alongside accumulating cultural wealth. Traversing the art market with knowledge, guided by adept professionals, not only multiplies one's tangible assets but also enriches the investor's engagement with human creativity.

Risk Management in Art Investment

Art investment is dynamic and comes with distinct risks. Hurdles such as market volatility, concerns over authenticity, and illiquidity must be managed to maintain a balanced, risk-mitigated portfolio.

Market volatility in art reflects broader economic conditions, ranging from spikes to depreciations influenced by cultural shifts, economic downturns, or even the death of an artist. Diversification is a key risk management strategy. Expanding one's collection across varied styles, periods, geographies, and artists can create a safety net, diluting risk.

Authenticity issues in artworks underpin significant risks. The provenance of a piece determines its market acceptance and value. Forgeries or misattributed works can evaporate investments once uncovered. Rigorous due diligence is imperative, including:

- Expert consultations

- Detailed condition checks

- Provenance verification aligning with scientific methods devised to verify the genuineness of art

Illiquidity is one of the trickiest facets in art investments. Unlike equity and bond markets where securities can typically be sold readily for cash, art necessitates finding the right buyer at the right price, a process that can be protracted. This encompasses specific risks for those requiring agile responses to financial demands. To mitigate such risks, staying in sync with prevailing market trends and cultivating personal connections within the art world is vital.

Insurance acts as a safeguard against potential physical damage or theft, guarding an artwork's value through time. Adequate, customized insurance provisions underpin security, aiming to address any possible issues that might emerge from unexpected changes in an artwork's situation or worth.

Navigating the art investment ecosystem is fraught with distinctive risks. However, with strategies such as diversification, due diligence processes, robust networking, and insurance frameworks, investors can shape a more resilient venture. As the possession journeys between investment and enjoyment, the ability to fuse astute commercial planning with personal affinity becomes necessary.

Art Investment Strategies

Investing in emerging artists embodies a venture garnished with both speculative zeal and risks. Navigating through a cohort still on the ascent could potentially capture significant capital growth as said artists gain prominence. Yet, the terrain is unpredictable, spurring one to gauge emerging trends against ephemeral fads.

In contrast, the sustained accumulation strategy ─ buying and holding ─ portends a lesser-frequented path. This methodology subsists on the belief of art's intrinsic value augmentation over elongated timelines. Such a venture exhorts patience, enduring market cyclicity, whilst watching the gradual bustle of appreciation tied to sought-after pieces.

The paradigm of flipping artworks invites a rigorous, dynamic approach. The cornerstone lies in acquiring undervalued pieces poised for prompt price ascensions detailed by market readiness or perceptual changes. The acumen to discerningly spot underpriced values and precise timings for their sale implicates a masterful aptitude contoured by extensive market insights.

Fractional ownership pierces through the conventional cloaks of solo acquisitions. This innovative stratagem democratizes entry to high-priced artworks. Through co-ownership, investors spread their fiscal exposure, co-agglomerating fractional shares of illustrious pieces, whether by coalescing with peer enthusiasts or through leveraging platforms designed to facilitate this mode of investment1. It allows minor-capital investors into grander plays and safeguards balanced diversification.

Each strategy embroiders its narratives onto the expansive canvases of investment. Whether one melds the patience required for nurturing a portfolio over time or aggrandizes the brisk legerdemain needed for flipping artworks; whether venturing into the pastures of emerging talents or weaving through the tapestry of fractional ties, the maze of art investment invites both poised periodicity and thrill. Astute strategy, peppered with a profound understanding, bespeaks of wielding a sculptured pathway in traversing through illustrious terrains marked by both prestige and uncertainties. A congruity between chosen investment pathways and individualistic fiscal aesthetics emerges requisite.

The Role of Digital Platforms in Art Investment

Digital platforms have recalibrated the art investment landscape. By integrating technologies such as blockchain and NFTs (non-fungible tokens), these platforms enhance accessibility, transparency, and security for art investors.

Blockchain technology boosts transparency and security in art transactions. Immutable by design, blockchain serves as an enduring ledger of authenticity and provenance—a paramount concern for art collectors. This prevents issues of forgery and disputes over ownership, instilling enhanced trust within the art market.

NFTs have burgeoned as pivotal instruments in transforming artworks into securely held digital assets. These digital representations provide a blockchain-supported certificate of authenticity and ownership. This digital providence opens new vistas for artists to market their works directly to the globe, unfettered by geographical or logistical restraints.

Online art platforms leveraging these technologies enhance the inclusivity of art investment. They break down traditional barriers to entry, such as high initial investments and insider knowledge. Through fractional ownership enabled by blockchain, smaller investors gain the opportunity to invest in high-end art pieces that would ordinarily be beyond their reach, rationalizing and spreading risk while encouraging diversity of collections2.

These digital platforms aggregate extensive data that can be leveraged for more informed decision-making. Data transparency and analytics lead to better strategic planning and buying choices by unveiling previously opaque market dynamics.

While digital innovation fosters accessibility, it also amplifies competition among collectors and investors to secure notable works. The cyber-physical junction posed by online art platforms requires robust cybersecurity measures to protect investments from online threats—a new direction of risk that investors must consider.

The role of digital platforms and emerging technologies in art investment marks a seminal shift from passive viewing to active digital collecting. This digital evolution reconstructs the marketplace into a more accessible, transparent, and secure environment, promising a broader democratization of art collection and investment. As the tangibility of art melds with the fluidity of digital tokens, the embrace of these innovations heralds a vibrant lexicon of opportunities.

In conclusion, the essence of art investment lies not merely in the potential for financial gain but in the profound engagement with cultural heritage. This dual pursuit enriches the investor's experience, blending economic objectives with a deeper appreciation of human creativity.

- Horowitz N. Art of the deal: Contemporary art in a global financial market. Princeton University Press; 2014.

- Velthuis O, Coslor E. The financialization of art. The sociology of economic life. 2020:444.